Want to visualize your financial future? A future net worth calculator can provide a powerful roadmap. This guide will walk you through choosing, using, and interpreting the results of a net worth calculator, helping you navigate the complexities and make informed financial decisions.

Understanding Your Net Worth

Before diving into calculators, let's clarify what net worth means. It's simply the difference between your assets (what you own) and your liabilities (what you owe). A positive net worth indicates you own more than you owe; a negative net worth means the opposite. Understanding this is the foundation for effective financial planning.

Choosing the Right Calculator: Simple vs. Complex

Net worth calculators range from simple to sophisticated. The best choice depends on your financial knowledge and goals.

Simple Calculators: These are user-friendly and ideal for a quick overview of potential future wealth. However, they often lack the detail for highly accurate long-term projections.

Complex Calculators: These offer detailed personalized projections but require more data input and financial understanding. They are better suited for in-depth planning and sophisticated analysis.

| Feature | Simple Calculator | Complex Calculator |

|---|---|---|

| Ease of Use | Very Easy | More Involved |

| Accuracy | Approximate | More Accurate (but still an estimate) |

| Data Needed | Minimal | Extensive |

| Time Commitment | Just a few minutes | Could take longer, depending on detail |

| Best For | Quick overview, beginners | Detailed financial planning, experienced users |

Using a Future Net Worth Calculator: A Step-by-Step Guide

While specific steps may vary, the core process remains consistent across most calculators.

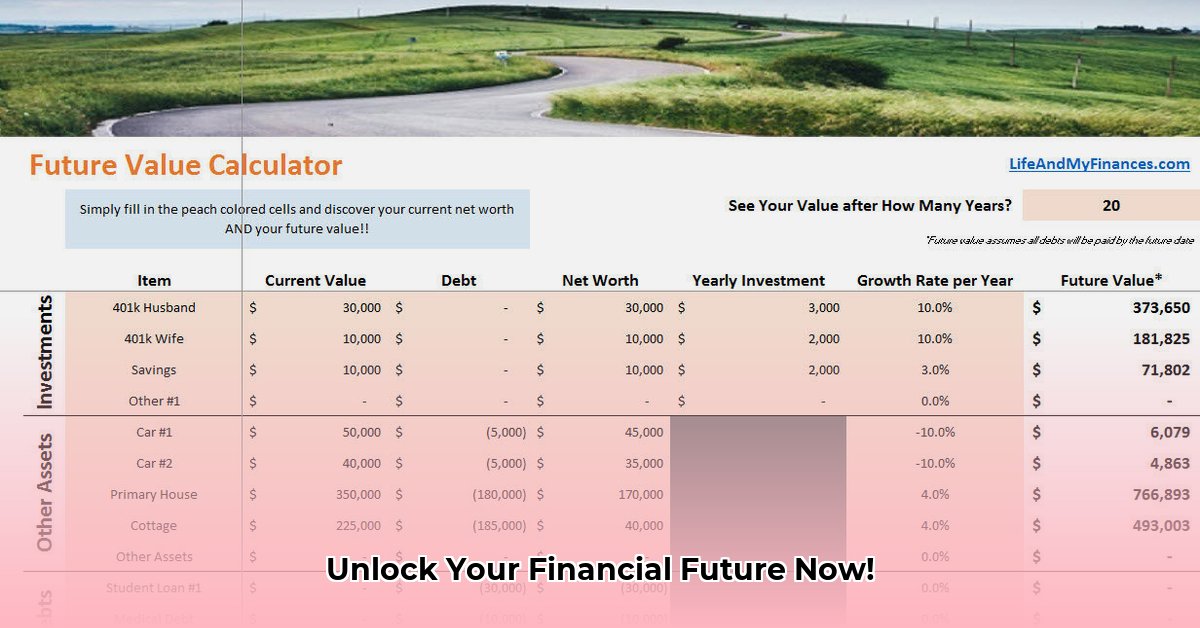

Step 1: Gather Your Asset Data. This includes cash, savings, investments (stocks, bonds, etc.), real estate, vehicles, and other valuable possessions. Be precise!

Step 2: Compile Your Liabilities Data. List all debts: mortgages, student loans, car loans, credit card balances, etc. Again, accuracy is vital.

Step 3: Project Future Asset Growth. Estimate how your assets will grow. Consider realistic rates of return for your investments. Conservative estimates are generally preferred.

Step 4: Project Future Liabilities. How will your debts change? Will you pay them down? Will you take on new debt? Realistic projections are crucial.

Step 5: Input and Calculate. Enter all your data into the calculator and let it generate a projected net worth for a specified future date (e.g., 5 years, 10 years, retirement).

Interpreting Your Results: Understanding the Projections

Remember, the output is a projection, not a guarantee. The accuracy depends heavily on the assumptions you made about future income, expenses, investment returns, and debt repayment. Consider it a valuable planning tool, not a fortune teller. How do these projections make you feel about your financial future? Do you need to adjust your savings plan?

Addressing Limitations and Risks: A Realistic Perspective

Net worth calculators are powerful tools, but have limitations. Life throws curveballs.

| Risk Factor | Potential Impact | Mitigation Strategy |

|---|---|---|

| Inaccurate Asset Valuation | Under or overestimation of net worth | Regular portfolio review, professional appraisal |

| Unexpected Debt Increase | Lower projected net worth | Emergency fund, responsible credit card usage |

| Unrealistic Growth Assumptions | Significantly skewed projections | Conservative estimates, professional financial advice |

| Market Volatility | Substantial impact on investment returns | Diversification, long-term investment strategy |

| Unexpected Expenses | Reduction in projected savings and net worth | Emergency fund, budgeting |

Next Steps: Actionable Insights

Your projected net worth provides valuable insights for refining your financial plan.

- Refine Financial Goals: Does your projection align with your goals? Adjust your plan if needed.

- Adjust Savings and Investing: Use the projection to determine how much you need to save and invest.

- Track Progress Regularly: Review and update your projections periodically to stay on track.

Consistent planning and adjustments are vital for long-term financial success. Building wealth is a marathon, not a sprint. Use this calculator as a guide, learn from the projections, and adapt your strategy as needed.